The days of storing your company’s financial history on a single dusty computer in the corner of the office are over.

For decades, "accounting" meant manual backups, confusing version updates, and sending files back and forth to your accountant via USB drives. It was slow, insecure, and isolated from the rest of the business.

Today, Online accounting software (often called Cloud Accounting) has changed the game. It isn't just about digitizing your ledger; it's about liberating your data. It allows business owners to check their cash flow from a coffee shop, send invoices from a smartphone, and collaborate with their accountant in real-time.

In this final guide of our series, we will explore why moving your finances to the cloud is the single most important step you can take for your business's longevity and security.

The Shift: From "Data Entry" to "Data Flow"

Traditional accounting was about looking back. You entered data about what happened last month. Online accounting software is about looking forward.

Because it connects to your bank feeds, your credit cards, and your sales channels, transactions flow in automatically. You stop typing data and start analyzing it.

- Bank Feeds: Instead of typing in every coffee you bought for a client meeting, the software pulls the transaction from your bank. You just click "Approve."

- Real-Time Reconciliation: You know exactly how much money you have right now, not how much you had on the 31st of last month.

Why "Standalone" Accounting Isn't Enough

Here is the secret that most software companies won't tell you: Accounting software is useless if it lives in a bubble.

Your financial numbers are the result of your operations. If your accounting tool doesn't know what your warehouse or sales team is doing, you are still doing manual work.

1. The Inventory Connection

If you buy stock, your accounting software needs to know the value of that asset. If it's disconnected, you have to manually calculate your Cost of Goods Sold (COGS). An integrated system handles inventory management best practices automatically, updating your balance sheet the moment a product leaves the warehouse.

2. The Profit Reality Check

Many businesses fail because they look at their bank balance and think they are rich. They forget about upcoming bills. Online accounting helps you visualize the difference between cash flow vs profit. It shows you "Accounts Payable" (what you owe) alongside "Accounts Receivable" (what people owe you), giving you the true picture of your solvency.

3. Controlling the Outflow

It's easy to focus on income, but what about spending? Online accounting allows you to automate your purchase orders. Instead of waiting for a surprise invoice from a vendor, the system tracks the expense from the moment you approve the purchase, ensuring your budget stays on track.

Security: Is the Cloud Safe?

This is the #1 question business owners ask. "Is my financial data safe on the internet?"

The honest answer? It is likely safer in the cloud than it is on your office computer.

- Physical Theft: If someone steals your office laptop, your data is gone. With online accounting software, your data lives on secure servers. You just buy a new laptop, log in, and keep working.

- Disasters: Fires, floods, or coffee spills don't destroy the cloud.

- Encryption: reputable providers use bank-level encryption (256-bit SSL) that is virtually impossible to hack—far stronger than the password on your office PC.

Features That Save You Hours Every Week

When choosing a platform, look for these specific automation features:

Automated Invoicing & Chasing

Don't just send invoices; set up the system to chase them. If a client is late, the software sends a polite reminder. This ensures you get paid for your work and helps reduce unbilled hours by catching missed payments early.

Project Profitability

For agencies, it’s vital to know if a specific project is making money. Good online accounting tags expenses and income to specific "Projects" or "Cost Centers."

Production Costing

For manufacturers, accounting is complex. You need to account for raw materials, labor, and overheads. Integrating your accounting with tools for streamlining production ensures that your "Cost per Unit" is accurate, so you set prices that actually yield a profit.

Conclusion: The Foundation of Growth

Your accounting software is the scorecard of your business. If the scorecard is messy, delayed, or inaccurate, you can't win the game.

Switching to online accounting software does more than save trees. It gives you the agility to make fast decisions, the security to sleep soundly, and the freedom to run your business from anywhere.

Don't let your finances lag behind. Experience the clarity of Webhuk’s integrated financial tools—where accounting meets operations, inventory, and sales in one seamless platform.

Frequently Asked Questions (FAQs)

1. Can I migrate my data from desktop software to the cloud?

Yes. Most online accounting platforms offer "migration services" or easy import tools. You can usually upload your Chart of Accounts, Customer Lists, and Vendor details via Excel. For historical transaction data, you might enter "Opening Balances" to start fresh from a specific date (e.g., April 1st).

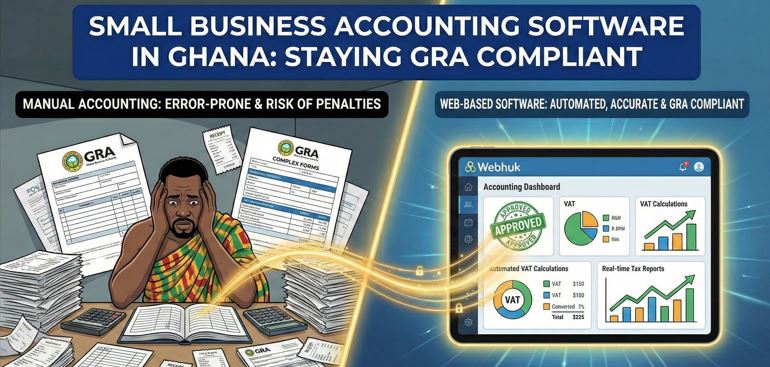

2. Is online accounting software compliant with tax laws?

Yes. Reputable platforms are updated automatically whenever tax laws change (like new GST/VAT rates). Unlike desktop software, where you have to buy the "2025 Version" to get the new tax rates, online software updates itself in the background.

3. How much does online accounting cost?

Most platforms operate on a monthly subscription model (SaaS), ranging from $10 to $50 per month depending on features and users. This is often cheaper than the large upfront cost of buying desktop licenses and paying for annual support contracts.

4. Can my accountant access my online data?

Yes, and this is a huge benefit. You can create a specific "Accountant Login" for your CPA. They can log in from their office to review your books, fix errors, and prepare tax returns without you ever having to email a file or drive to their office.

5. What happens if the internet goes down?

While you do need an internet connection to access real-time data, many mobile apps for online accounting allow you to work "offline" (e.g., snap photos of receipts or create invoices) and will sync the data automatically once your connection is restored.