Introduction: The "Paper Rich, Cash Poor" Paradox

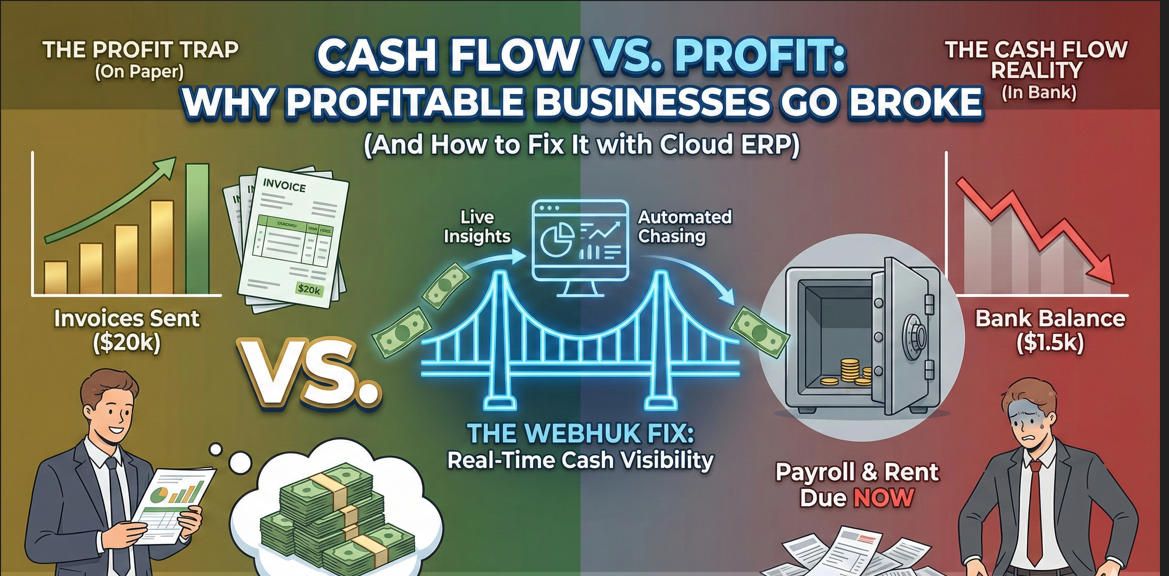

It is a story that happens every day. A business owner looks at their monthly Profit & Loss (P&L) statement. The bottom line shows a healthy $20,000 Net Profit. They celebrate. They might even order a new coffee machine for the office.

Two days later, payroll is due. They check the bank account. Balance: $1,500.

Panic sets in. “How is this possible?” they ask. “My accountant said we made $20,000! Where is the money?”

This is the "Paper Rich, Cash Poor" paradox. It is the single biggest reason why small businesses fail. In fact, studies show that 82% of business failures are due to poor cash flow management, not lack of profit.

In this guide, we are going to untangle the confusion between Profit and Cash. We will explain why waiting for end-of-month reports is a dangerous habit, and how switching to Real-Time Cash Flow Tracking can save your business from disaster.

Profit vs. Cash Flow: What is the Difference?

To manage your business, you need to understand that these two numbers tell two completely different stories.

1. Profit (The Theory)

Profit is an accounting concept. It is calculated as Revenue - Expenses.

- The Catch: In Accrual Accounting (which most businesses use), "Revenue" is recorded the moment you send an invoice—not when you get paid.

- Example: You finish a project and invoice a client for $10,000 on Jan 1st. On paper, you have $10,000 profit. But the money hasn't hit your bank yet.

2. Cash Flow (The Reality)

Cash Flow is the actual movement of money in and out of your bank account.

- The Reality: You have to pay rent, salaries, and suppliers now. You cannot pay your employees with an "invoice sent to a client." You can only pay them with cash in the bank.

The Danger Zone: If your "Profit" is tied up in unpaid invoices (Accounts Receivable) or unsold stock (Inventory), you can be wildly profitable and technically bankrupt at the same time.

The "Lag" Problem: Why Monthly Reports Are Too Slow

Most SMEs manage finance by looking into the rearview mirror. You send your receipts to your accountant at the end of the month. They process them. By the 15th of the next month, they send you a PDF report.

This is too late. A report on February 15th tells you that you ran out of money on January 20th. You cannot fix a problem that happened three weeks ago.

In 2025, business moves too fast for monthly reports. You need to know your cash position right now.

- Did that big client pay this morning?

- Did that supplier check clear yesterday?

- Do we have enough cash to cover payroll next Friday?

This is where Real-Time Tracking comes in.

The Solution: Managing by Dashboard, Not by Spreadsheet

Modern Cloud ERPs like Webhuk replace static PDF reports with a live Financial Dashboard.

Imagine a cockpit. You don't want the pilot to check the fuel gauge once every 30 days. You want them to see the fuel level constantly.

Here is what Real-Time Tracking gives you:

1. The "Cash Runway" View

Webhuk connects to your invoicing and expense modules to calculate a live "Cash Position." It answers the question: “If no new sales come in, how long can we survive?” Knowing you have 45 days of runway vs. 10 days of runway changes every decision you make.

2. Automating Accounts Receivable (The Cash Collector)

The fastest way to fix cash flow is to get paid faster.

- Old Way: You remember to chase a client 2 weeks after the invoice is overdue.

- Webhuk Way: The system sees the invoice is overdue. It sends an automated, polite reminder email to the client with a payment link.

- Result: You get paid in 35 days instead of 60 days. That is 25 extra days of cash in your pocket.

3. Inventory Visibility

Inventory is just piles of cash sitting on a shelf. Real-time tracking highlights "Slow Moving Stock." It tells you: "You have $5,000 worth of Item X that hasn't sold in 6 months."

- Action: You run a discount sale to convert that dead stock back into liquid cash immediately.

3 Strategies to Fix a Cash Crunch Immediately

If your dashboard shows a cash dip coming up, here are three tactical moves you can make using your ERP data.

1. Negotiate "Terms" (The 30/60 Rule)

- Strategy: Try to get paid in 30 days, but pay your suppliers in 60 days.

- How ERP helps: Run an "Aging Report" on your Payables. See which suppliers you pay instantly. Call them and ask: "Since we are a loyal customer, can we move to Net-45 terms?" This keeps cash in your bank for 15 extra days.

2. Incentivize Early Payments

- Strategy: Offer a small discount (e.g., 2%) if clients pay within 7 days.

- How ERP helps: Add this note automatically to your invoice templates in Webhuk. 2% is a small price to pay for immediate liquidity.

3. Request Deposits

- Strategy: Never start big work for free. Ask for 50% upfront.

- How ERP helps: Create a "Milestone Invoice" in Webhuk. Send the 50% invoice immediately upon quote acceptance. Do not start work until the system flags it as "Paid."

Conclusion: Sleep Better with Visibility

Financial anxiety usually comes from the unknown. It’s lying awake at 2 AM wondering if a check will bounce.

Real-time cash flow tracking cures that anxiety. It turns the lights on. Even if the news is bad (e.g., "Cash is tight next week"), knowing it now gives you time to fix it. You can delay a purchase, chase a debtor, or inject capital.

Don't settle for "Paper Profit." Demand Cash Visibility.

See Your Cash Flow in Real-Time

Stop waiting for your accountant's monthly email. Webhuk.io gives you a live Financial Dashboard that shows your Profit, Cash, and Runway in one glance.

- Automated Invoice Chasing.

- Live Bank Status.

- Profit vs. Cash Reports.

Start Your 7-Day Free Trial – Turn the lights on in your business. See how top SMEs track their money.

Frequently Asked Questions

1. How is it possible to be profitable but have no money in the bank?

This is the classic "Paper Rich, Cash Poor" scenario. In accounting, "Profit" is recorded the moment you send an invoice, not when the money actually arrives. So, on paper, you look wealthy because you have earned the money. However, until the client actually transfers the funds, you can’t use that "profit" to pay rent or payroll. Cash flow is the reality of what is currently available to spend.

2. Why isn’t my monthly P&L statement enough to manage my business?

The problem with a standard Profit & Loss statement is the "lag." By the time your accountant sends you the report for January, it is likely the middle of February. You are looking at history, not the present. If a cash crisis started forming three weeks ago, a monthly report tells you about it too late to fix it. Real-time tracking allows you to make decisions based on where your money is today.

3. What does "Cash Runway" mean?

Think of your business like an airplane. Your "Cash Runway" is a calculation of how long your business can keep running (paying staff, rent, bills) using the cash you currently have, assuming you don't make a single new sale. Knowing you have a "45-day runway" versus a "10-day runway" is crucial for sleeping better at night and making safe business decisions.

4. How does an ERP system help get invoices paid faster?

We are all human, and sometimes we forget to chase clients for payment. An ERP like Webhuk automates this process. Instead of you remembering to email a client two weeks after a due date, the system detects the overdue invoice and sends a polite, automated reminder with a payment link. This consistent nudging often reduces payment times significantly without you having to do the awkward manual follow-up.

5. Is requesting a deposit upfront unprofessional?

Not at all—in fact, it is a standard safety practice for healthy businesses. Requesting a 50% deposit ensures you have the cash flow to cover the costs of doing the work before you start. It also filters out non-serious clients. As mentioned in the article, you can use your software to create a "Milestone Invoice" so work doesn't begin until that initial safety net is in your bank account.