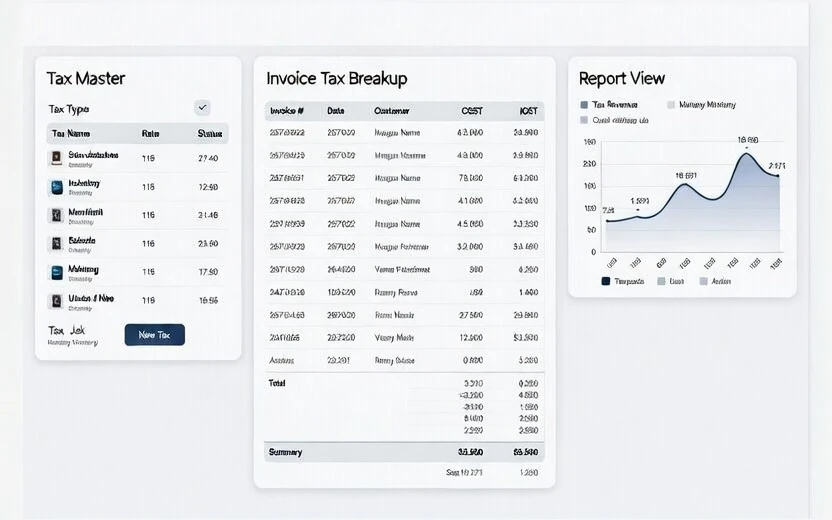

Tax compliance across locations-without manual corrections on every invoice.

Multi-location operations create tax complexity: different rates, different rules, and different invoice requirements. Webhuk Multi-Jurisdiction Taxes helps you configure jurisdiction-wise rules so the system applies the correct tax based on your location setup and transaction context. This reduces invoice errors, improves audit readiness, and protects margin visibility.