Running a small business in Ghana is a balancing act.

You are juggling supplier prices that change with the dollar, electricity stability (dumsor), and the constant need to keep customers happy. But recently, a new challenge has taken center stage: The Ghana Revenue Authority (GRA).

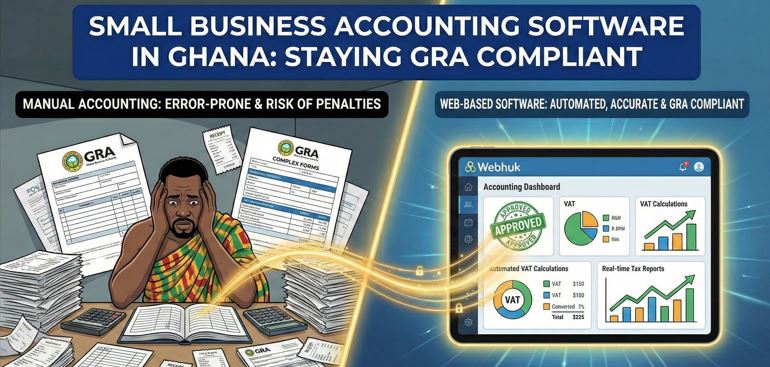

With the aggressive rollout of the E-VAT (Electronic VAT) system and tighter enforcement on tax compliance, the days of "manual books" are over. If your business cannot produce a Certified Digital Invoice at the point of sale, you are at risk of heavy fines or having your shop sealed.

This reality has driven thousands of Ghanaian business owners to search for small business accounting software. They aren't just looking for a way to track sales; they are looking for safety.

In this guide, we will explore why moving to digital accounting is the smartest move for your business and how to choose a system that keeps you compliant without breaking the bank.

The "Manual" Trap in a Digital Economy

For years, many shops in Makola, Osu, and Kantamanto relied on the "notebook system." You wrote down what you sold, and maybe once a month, you gave that book to an accountant.

This method is now dangerous for three reasons:

1. The E-VAT Mandate

The GRA now requires that transactions be validated in real-time. When you sell a product, your system needs to talk to the GRA server to get a digital security stamp (SDC). A notebook cannot do this. A manual receipt book cannot do this. Only small business accounting software integrated with the GRA API can ensure you are trading legally.

2. The "Missing Receipt" Nightmare

Have you ever tried to claim Input VAT deductions, only to realize you lost the supplier's invoice? Or the thermal paper faded? In a digital system, every expense is snapped, uploaded, and stored forever. You never overpay tax because you can prove every single cedi of business expense.

3. Audit Anxiety

When the GRA auditors visit, they want to see records. If you hand them a pile of dusty papers, they will dig deeper. If you open a dashboard and show them organized, professional Profit & Loss statements, the audit is usually faster and less painful.

What to Look for in Accounting Software for Ghana

Most "famous" global software isn't built for Ghana. It doesn't know about NHIL (2.5%), GETFund (2.5%), or the COVID-19 Levy (1%).

When choosing small business accounting software, you need specific local features:

1. Custom Tax Configuration

You cannot just have a single "Tax" line. Your invoice needs to break down the levies clearly.

- Bad Software: "Tax: 15%"

- Good Software: "Net Value + NHIL + GETFund + COVID Levy + VAT = Total." If your software can't do this breakdown automatically, your monthly returns will be wrong.

2. Multi-Currency Capability

If you import goods from China or Dubai, you pay in USD or RMB. But you sell in Cedis. You need software that tracks the purchase in foreign currency and the sale in local currency, automatically calculating the exchange rate loss or gain. This is crucial for knowing your true profit.

3. Mobile Money Integration

In Ghana, Cash is no longer King—Mobile Money is. Your software must treat MoMo wallets (MTN, Vodafone/Telecel, AT) like bank accounts. You should be able to reconcile your MoMo sales just as easily as your bank transfers.

The Hidden Value: "Bankability"

Beyond taxes, there is another massive reason to upgrade. Loans.

Ghanaian banks are hesitant to lend to SMEs because they consider them "high risk." Why? Because they can't verify the cash flow. If you walk into a bank with a handwritten ledger, they will likely say no. If you walk in with a generated Cash Flow Statement and Balance Sheet from a reputable accounting system, you look like a professional entity. You are "bankable."

Cloud vs. Desktop: What Works in Ghana?

A common question is: "Should I buy software I install on my computer, or use the cloud?"

In the Ghanaian context, Cloud is safer.

- Theft: Laptops get stolen from cars and offices frequently. If your data is on the hard drive, it's gone. If it's in the cloud, you just buy a new laptop and log back in.

- Viruses: Local networks are often infected via USB drives. Cloud software is immune to local viruses.

- Access: You can check your sales from home. You don't need to be physically in the shop to know how much money was made today.

Conclusion: Compliance is a Competitive Advantage

Many business owners view accounting software as a "grudge purchase"—something they have to buy.

Shift your mindset. Think of small business accounting software as your digital shield. It protects you from GRA penalties. It protects you from employee theft. It protects you from losing track of your money.

In a market as competitive as Ghana, the business with the best data wins. Don't let your hard work be undone by poor record-keeping.

Ready to simplify your taxes? Webhuk offers the locally-tailored accounting tools you need to master your finances and stay E-VAT compliant.

Frequently Asked Questions (FAQs)

1. Do I need to be an accountant to use this software?

No. Modern small business accounting software is designed for non-accountants. It uses simple language like "Money In" and "Money Out" instead of "Debits" and "Credits." If you can use Facebook, you can use these tools.

2. Does the software generate the GRA E-VAT QR code?

Yes, if you choose a compliant provider like Webhuk. The system connects to the GRA API, receives the validation code, and prints it directly on your customer’s invoice or receipt.

3. Can I use it on my phone?

Yes. Most cloud accounting platforms have mobile apps. This is perfect for checking sales while stuck in traffic or issuing a quick invoice when you are out meeting a client.

4. What happens if I make a mistake on a tax invoice?

In a compliant system, you cannot just "delete" a certified invoice. You must issue a Credit Note to reverse it. This creates a proper audit trail that the GRA expects to see.

5. Is it expensive for a small shop?

No. Cloud software is sold as a monthly subscription (SaaS), often costing less than your monthly internet data bundle. It is far cheaper than hiring a full-time accountant or paying a fine for non-compliance.