If you run a small business, you know the "Spreadsheet Dance."

You have one sheet for inventory, another for sales, a third for customer contacts, and maybe a sticky note system for invoicing. It works—until it doesn't. Suddenly, an order gets missed, stock runs out unexpectedly, or you spend an entire Friday night trying to reconcile numbers that just won't match up.

This is the growing pain every successful small business faces. The solution isn't working harder; it's bringing your data together.

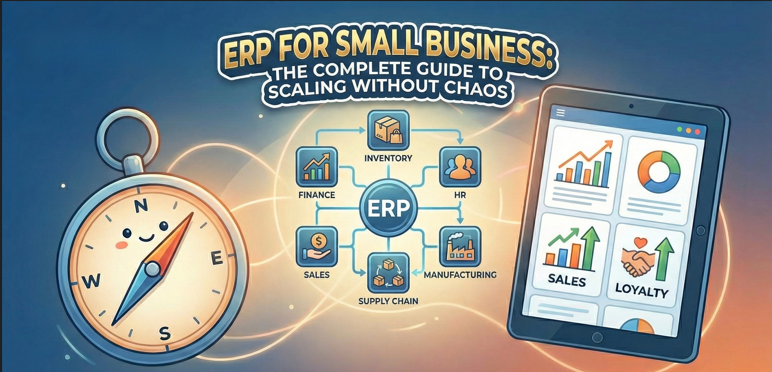

Enter ERP (Enterprise Resource Planning).

For years, people thought ERPs were expensive, clunky systems reserved for Fortune 500 giants. That is no longer true. Today, ERP for small business is not just accessible; it’s the secret weapon agile companies use to overtake their slower competitors.

In this guide, we’ll break down what an ERP actually does for a small business, the warning signs that you need one now, and how to choose a system that pays for itself.

What is ERP, Really? (And Why Should You Care?)

Strip away the jargon, and ERP is simply a central brain for your business.

Instead of having your accounting software in one silo, your inventory in another, and your CRM in a third, an ERP connects them all. When your sales team closes a deal, the ERP automatically updates your inventory, notifies the warehouse, and creates an invoice for finance.

For a small business, this means:

- No more double data entry: Stop typing the same customer name into three different apps.

- One version of the truth: Everyone looks at the same real-time numbers.

- Fewer mistakes: Automation reduces the human error that leads to lost revenue.

5 Signs Your Small Business Needs an ERP

How do you know if you are ready to graduate from basic tools to an ERP? If you find yourself nodding to any of the following, it’s time.

1. You Are Flying Blind on Inventory

Do you know exactly how much stock you have right now? Or do you have to physically walk to the shelf to check? If you are constantly overstocking "just in case" or losing sales because of stockouts, you are leaking money. An ERP gives you real-time visibility and helps you master inventory management best practices like FIFO and Weighted Average valuation.

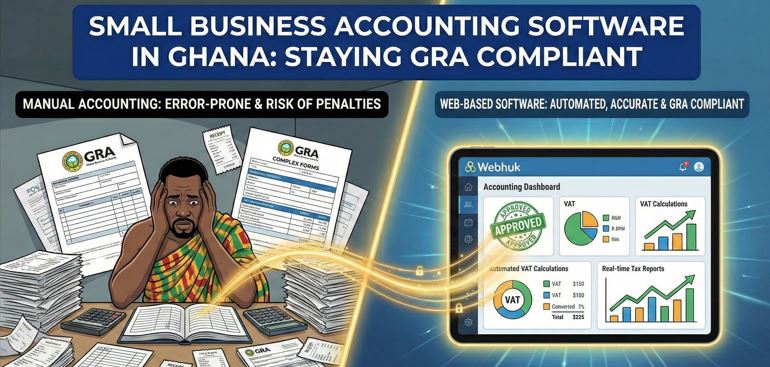

2. Your Spending is Out of Control

Are your team members buying supplies without approval? Are you unsure where your cash went at the end of the month? An ERP allows you to automate your purchase orders, setting strict approval limits so you can stop uncontrolled spending before it happens.

3. You Don't Know Your Real Profit

There is a massive difference between having money in the bank and actually being profitable. Many businesses fail because they don't understand the nuances of cash flow vs profit. An ERP tracks every cent, showing you which product lines are actually making money and which are draining your resources.

4. You Have Too Many "Workarounds"

If your team relies on a complex web of Google Sheets, emails, and verbal reminders to get an order out the door, your process is fragile. One person getting sick could break the whole chain.

5. You Are Losing Billable Hours

For service-based businesses, lost time is lost money. If you are struggling to track time effectively, you need a system that helps reduce unbilled hours and ensures you get paid for every minute of work you do.

The Specific Benefits of ERP for Small Businesses

Investing in software is a big decision. Here is the ROI you can expect.

Reduced Operational Costs

It sounds counterintuitive to spend money to save money, but ERPs reduce administrative overhead significantly. By automating routine tasks—like generating POs or invoices—you save hundreds of labor hours annually.

Streamlining Production

For manufacturers, chaos on the shop floor kills efficiency. An ERP helps in streamlining production by aligning your raw material orders with your production schedules, ensuring you have exactly what you need, when you need it.

Scalability

A good modern ERP grows with you. You might start with just the Accounting and Inventory modules. As you grow, you can add HR, CRM, or Manufacturing modules without having to migrate to a whole new system.

Cloud vs. On-Premise: What is Best for SMEs?

For 99% of small businesses today, Cloud ERP is the right choice.

- Lower Upfront Cost: You pay a monthly subscription rather than buying expensive servers and licenses.

- Access Anywhere: You can check your business performance from your phone while on vacation (or just from home).

- Security: Cloud providers spend more on security than a small business ever could.

How to Choose the Right ERP

The market is flooded with options. Here is a checklist to help you filter them:

- Ease of Use: If it requires a PhD to operate, your team won't use it. Look for intuitive interfaces.

- Integration: Does it play nice with the tools you want to keep (like your e-commerce store or bank)?

- Support: As a small business, you don't have an IT department. You need a vendor that offers excellent customer support.

- Industry Fit: A generic ERP is okay, but one tailored to your specific flow (like manufacturing or retail) is better.

Conclusion: Stop Managing the Chaos, Start Managing the Business

Staying small doesn't mean thinking small. The transition from spreadsheets to an ERP for small business is the bridge between a chaotic startup and a mature, scalable organization.

Don't wait until your current systems completely break down. Start exploring your options today and give your business the solid foundation it deserves.

Ready to streamline your operations? Explore how Webhuk’s tailored solutions can help you automate your purchase orders and gain control over your business today.

Frequently Asked Questions (FAQs)

1. Is an ERP software expensive for a small business?

Not necessarily. Modern cloud-based ERP solutions offer subscription models (SaaS) that are very affordable for small businesses. You pay for what you use, avoiding the massive upfront costs associated with traditional enterprise software.

2. How long does it take to implement an ERP?

For small businesses, a cloud ERP implementation can take anywhere from a few weeks to a few months. This is significantly faster than the year-long projects typical of large corporations, especially if you choose a user-friendly system.

3. Can I integrate an ERP with my existing software?

Yes. Most modern ERP for small business systems are built with integration in mind. They can connect with your e-commerce platforms (like Shopify), payment gateways, and other specialized tools via APIs.

4. What is the difference between CRM and ERP?

A CRM (Customer Relationship Management) focuses on the "front end"—sales, marketing, and customer interactions. An ERP (Enterprise Resource Planning) covers the "back end"—inventory, accounting, supply chain, and operations. Many ERPs include a CRM module to keep everything connected.

5. Do I need an IT team to manage an ERP?

If you choose a cloud-based ERP, you generally do not need an in-house IT team. The vendor handles maintenance, updates, and security, allowing you to focus on using the software rather than fixing it.