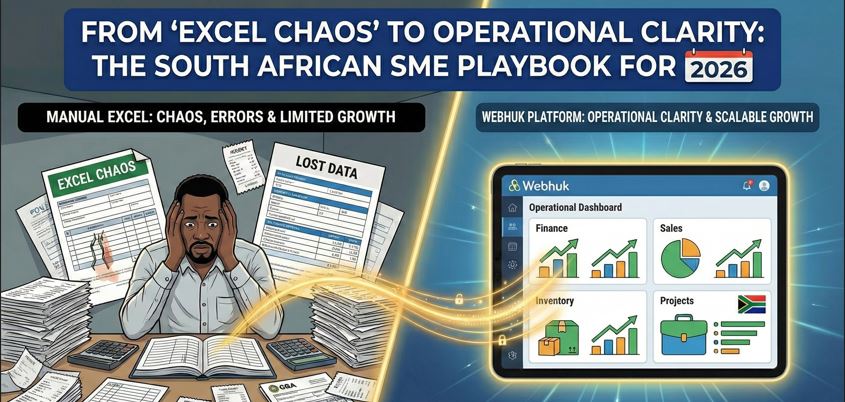

For many years, the standard operating procedure for a South African SME—whether a boutique agency in Cape Town or a distribution hub in Sandton—was simple: Microsoft Excel. It was the "Swiss Army Knife" of business. You used it for quotes, inventory, payroll, and even as a makeshift CRM.

However, as we move through 2026, the "Spreadsheet Era" has hit a wall. A recent industry study found that 88% of business spreadsheets contain significant errors. In a landscape defined by strict data privacy laws (POPIA) and a push for real-time tax transparency by SARS, those errors are no longer just annoying—they are expensive.

Why 2026 is the "Year of the Upgrade" in South Africa

The South African business environment has evolved rapidly. Today, three major factors are forcing SMEs to abandon manual tools:

- POPIA Enforcement is Real: The Information Regulator has begun random audits. Storing customer names and IDs in unencrypted Excel files that are emailed back and forth is a direct violation of the Protection of Personal Information Act (POPIA). Fines can now reach up to R10 million.

- SARS Digital Transformation: SARS is increasingly moving toward "continuous compliance." Waiting until month-end to manually calculate VAT in a spreadsheet is a recipe for penalties.

- The Load-Shedding Resilience Gap: Local servers and desktop-bound spreadsheets are vulnerable. When the power goes out, your data is trapped. Cloud-based ERP systems allow your team to keep working from mobile devices with 100% data uptime.

The Cost of Doing Nothing: The Hidden "Excel Tax"

When you stay on spreadsheets, you aren't saving money; you are paying a "hidden tax" in lost productivity:

- Version Control Issues: Sales has one stock list, the warehouse has another. You sell an item that isn't actually in stock, leading to a refund and a frustrated customer.

- Manual Reconciliations: Your finance team spends 3 days a month just "cleaning" data instead of analyzing it.

- Security Risks: If a disgruntled employee leaves with a copy of your "Customer_List_2026.xlsx," your entire business intelligence is gone.

How to Move from Excel to Webhuk in 5 Steps

Transitioning to an ERP doesn't have to be a "big bang" project that disrupts your office for weeks. At Webhuk, we’ve designed a migration path specifically for the South African "Middle Market."

Step 1: Audit Your "Critical Cells"

Identify which spreadsheets are currently "running" your business. Usually, it's three main areas: Customer Data, Inventory/Stock, and Supplier Quotes. Webhuk allows you to import these directly into our [Tradeboard] and [CRM] modules.

Step 2: Clean Your Data

This is the most important step. "Garbage in, garbage out." Before moving to Webhuk, remove duplicate entries and standardize your naming conventions (e.g., ensure "Company Ltd" isn't also "Company Limited").

Step 3: Centralize Your Financials

Stop tracking expenses in one file and invoices in another. Webhuk’s [Accounting and Ledger] system automatically links your sales to your expenses, giving you a real-time view of your cash flow—critical for managing the volatile Rand.

Step 4: Implement Role-Based Access

In a spreadsheet, everyone sees everything. In Webhuk, you can set permissions. Your sales team can see leads, but only your Finance Manager can see the bank balances. This is a core requirement for POPIA compliance.

Step 5: Activate Mobile-First Workflows

Train your team to use the Webhuk mobile interface. Whether they are at a client site or working from home, they should update the system in real-time. This eliminates the "Friday Afternoon Data Entry" rush.

Why Webhuk is the Best ERP Solution for SA SMEs

Unlike global ERPs that are over-complicated and priced in Dollars or Euros, Webhuk offers a "Zero-Bloat" experience tailored for the local market:

- POPIA-Ready Infrastructure: We use enterprise-grade encryption and role-based access to safeguard your data.

- SARS-Friendly Reporting: Generate VAT201-ready reports with one click via our [Financial Reporting tools].

- Scalable Pricing: Pay for what you use. As your Johannesburg office expands to Durban and Gqeberha, Webhuk grows with you.

Conclusion: Future-Proof Your Business

In 2026, the most successful South African businesses will be the ones that are "data-literate." Moving away from Excel isn't just about getting new software; it's about building a foundation for growth that is secure, compliant, and visible from anywhere.

Frequently Asked Questions (FAQs)

1. Is Webhuk hosted in South Africa for POPIA compliance? Yes. Webhuk utilizes secure cloud infrastructure that meets the stringent data sovereignty and protection requirements of the Protection of Personal Information Act (POPIA). Your data is encrypted both at rest and in transit.

2. Can I still use Excel with Webhuk? Absolutely. We know many accountants love Excel for specific deep-dive analysis. Webhuk allows you to export any report (Sales, Inventory, Ledgers) to a clean CSV or Excel format for further manipulation, while keeping the "Master Data" secure in the ERP.

3. Does Webhuk support the current SARS VAT rates? Yes. Webhuk is pre-configured with South African tax logic. Whether the VAT rate is 15% or if there are specific zero-rated items for your industry, our Accounting Features handle the calculations automatically.

Is your business still trapped in a spreadsheet? Join the wave of South African SMEs moving to a smarter, safer way of working. Get the visibility you need to scale without the Excel-induced headaches.

👉 Book a Free Webhuk Demo for Your SA Business